- Digital Wealth Insider Newsletter

- Posts

- The Market Just Told Us What Crypto Actually Is

The Market Just Told Us What Crypto Actually Is

Gold hedges fear. Bitcoin hedges policy. Altcoins price innovation

The Market Just Told Us What Crypto Actually Is

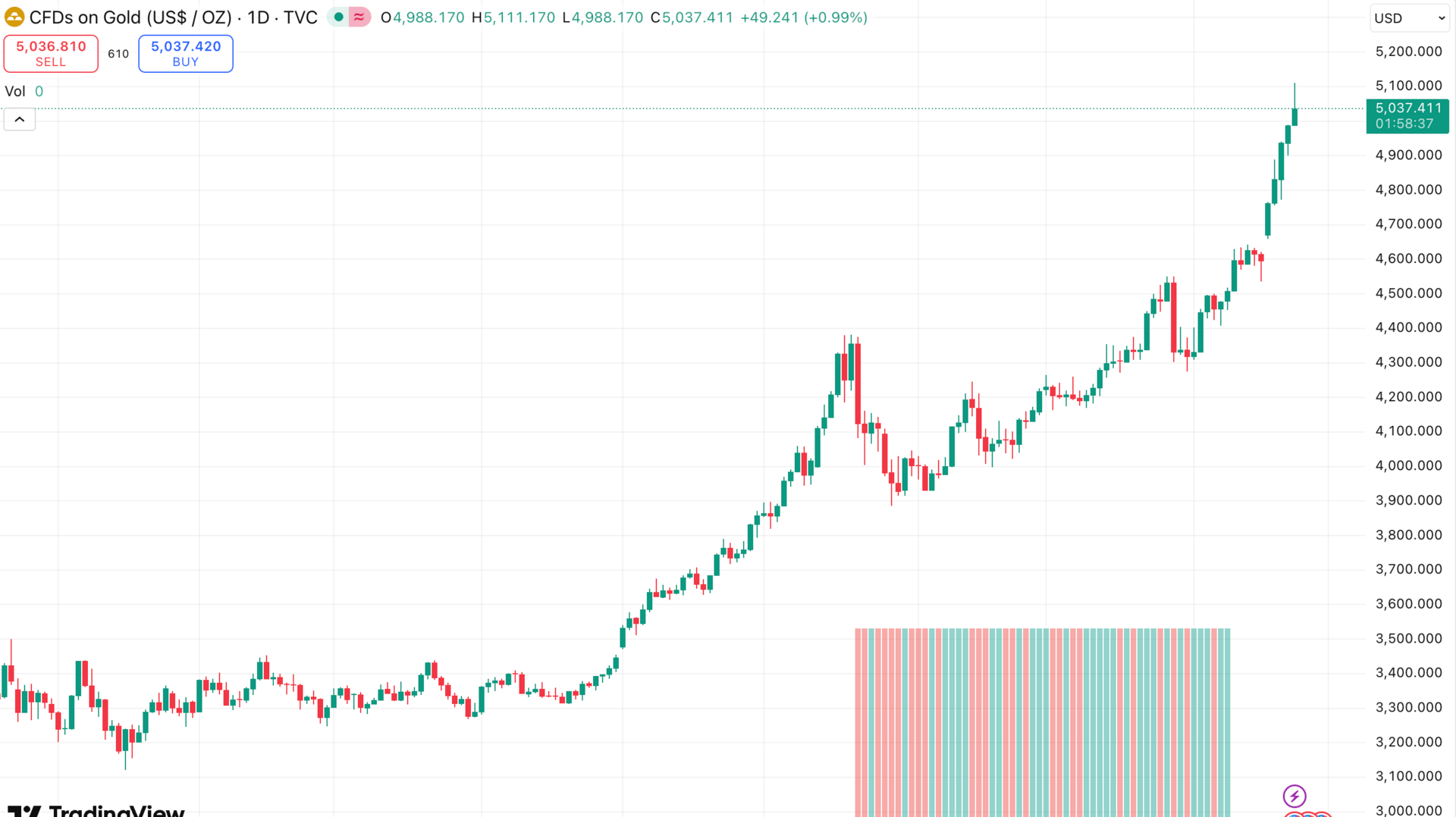

Gold just touched $5,000.

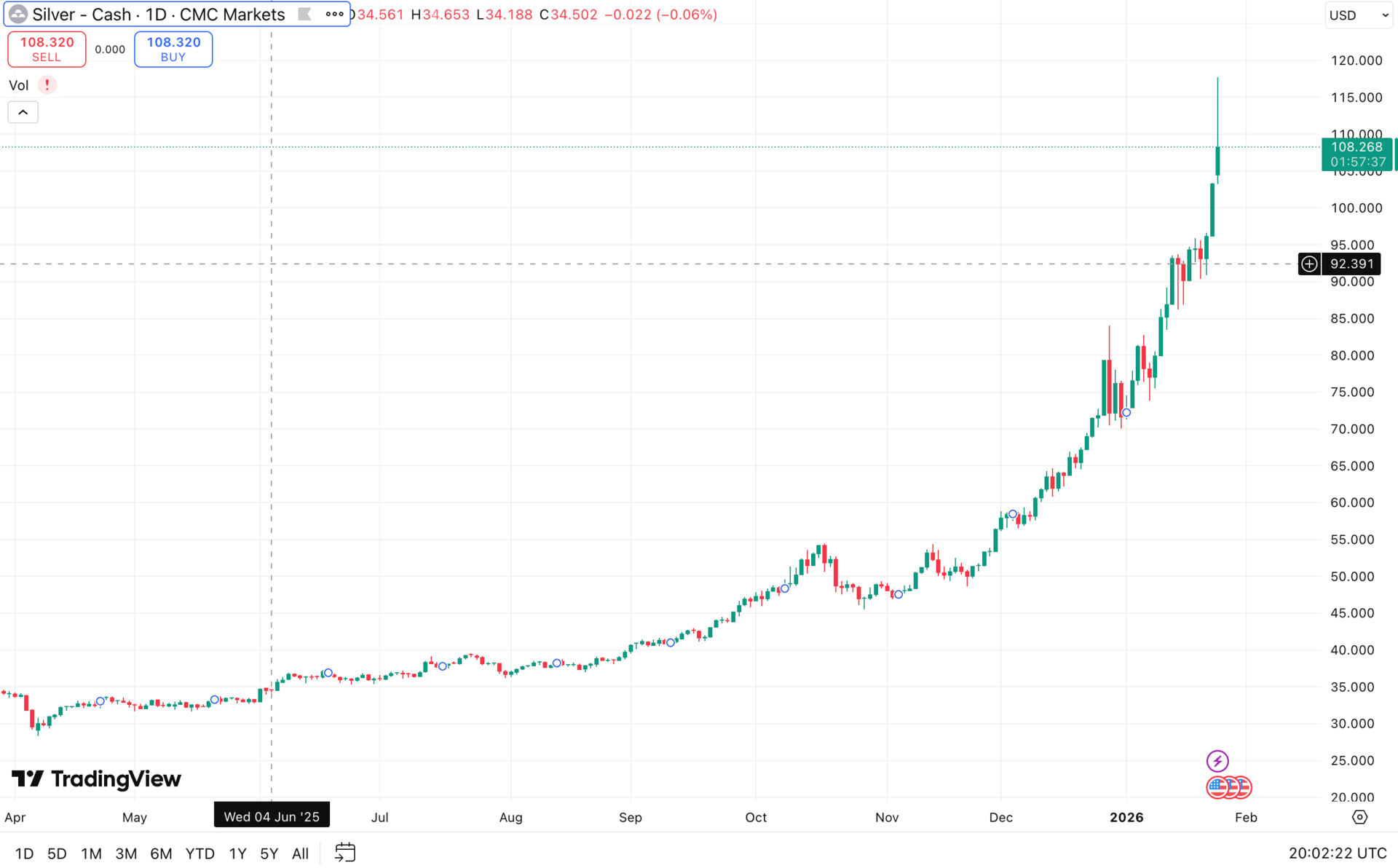

Silver crossed $100 for the first time in history.

Tech has held up. AI capex is still flowing.

And crypto? Still grinding. Still waiting.

If you've held through 2025, you don't need me to tell you it's been frustrating. You've questioned the thesis. That's rational - price has been a terrible teacher this year.

But something important just happened in this divergence - and most people are missing it.

The Setup: Three Assets, Three Different Bids

Let's look at what actually moved.

Gold touched ~$4,988 intraday this week - a new all-time high. It's up over 60% year-over-year, its best annual performance in decades. Central banks bought 297 tonnes through November alone. Global ETF inflows were among the strongest on record.

Silver crossed $100/oz for the first time ever. Up around 145% in 2025. Solar now represents roughly 30% of industrial demand. The market is running its fifth consecutive annual supply deficit.

Large-cap tech held up on fundamentals. AI infrastructure spending continues. Earnings have been solid.

And crypto?

Bitcoin peaked near $126,000 in October. It's now around $90,000 - down 25-30% while gold printed new highs.

That's the divergence. Now let's talk about what it means.

The Obvious Read: Crypto Is in No-Man's Land

On the surface, this looks bad for crypto.

Gold is catching the uncertainty bid - geopolitics, tariffs, central bank demand, dollar weakness.

Tech is catching the earnings bid - real cash flows, real margins, real infrastructure buildout.

Crypto is catching neither.

It's not defensive enough to attract the gold flows. Institutions reaching for safety are reaching for what they know - and that's not a 15-year-old asset class.

It's not "productive" enough to attract the tech flows. Most tokens don't have earnings. They don't have cash flows. They can't compete with Nvidia's margins.

So crypto sits in no-man's land. A liquidity-sensitive asset class without the liquidity tailwind.

That's the obvious read. And it's not wrong.

But it's incomplete.

The Deeper Read: Not Failure - Clarification

Here's what most people are missing:

Bitcoin was supposed to be "digital gold." The hedge. The store of value. The thing that protects you when uncertainty spikes.

Gold is doing exactly that right now. It's up over 60%. It's absorbing the fear bid. It's doing its job.

Bitcoin isn't following.

The correlation broke. The narrative cracked. In real-time, under stress, BTC did not behave like gold.

That's not a failure. That's a clarification.

But the clarification isn't as simple as "crypto is tech, not gold." That's too binary.

The sharper framing:

Gold is the hedge in stress. Bitcoin is the hedge on the policy response to stress.

Gold moves when fear spikes. Bitcoin moves when liquidity arrives - when the Fed pivots, when conditions loosen, when risk appetite returns.

They're not the same trade. They're sequential.

A Framework for What's Actually Happening

Think of it as a 2x2:

Crisis Hedge | Growth / Innovation Exposure | |

|---|---|---|

Proven Institutional Bid | Gold | Large-cap Tech (Mag 7) |

Emerging / Maturing | Bitcoin (policy-response) | Altcoins (selective fundamentals) |

Gold and tech have the proven institutional bid. Capital flows there by default.

Bitcoin is maturing into a "policy-response hedge" - not a crisis hedge like gold, but not just another tech stock either. It moves when liquidity turns.

Altcoins are the innovation exposure layer - but only the ones with real fundamentals will catch institutional flows as the space matures.

This framework explains why the current divergence isn't a bug. It's the market correctly sorting assets by function.

Where We Are in the Cycle (And Why This Feels So Wrong)

This divergence isn't random. Markets move in phases - not all at once.

Phase 1: Stress appears. Capital seeks safety. Gold rallies. Energy spikes. Volatility rises. Risk assets underperform.

Phase 2: Pressure builds. Growth slows. Debt rollovers strain. Markets grind sideways. Nothing feels investable.

Phase 3: Policy response. Rates fall. Liquidity expands. Financial conditions loosen.

Phase 4: Risk repricing. Equities move. Crypto follows. Then smaller, higher-beta assets reprice violently.

We've been stuck in Phases 1 and 2. That's the phase that breaks people psychologically - because every day you hold crypto feels like evidence you're wrong.

But this sequence has played out before. And when it does, the lag between hard assets and crypto has historically been where the biggest asymmetry lives.

The Historical Pattern: Hard Assets Lead, Crypto Follows

This isn't theory. It's happened before.

2020: Gold's COVID rally then Bitcoin's bull run

Gold rallied from about $1,450 to $2,075 by August 2020. At that moment, Bitcoin was trading around $11,000-$12,000. The "digital gold" narrative felt dead. Gold was doing its job. Bitcoin wasn't.

Then the Fed's liquidity response kicked in. By May 2021 - roughly 9 months later - Bitcoin hit $64,000. A 5x move from gold's peak.

Gold led. Policy responded. Crypto followed.

2019: Fed pivot then parallel rally

Gold rallied through the first half of 2019 as trade war fears spiked and the Fed signaled rate cuts. Bitcoin spent Q1 2019 stuck around $3,500-$4,000.

By June 2019, as rate cuts became certain, Bitcoin had rallied to $13,000. Both assets moved on the same catalyst - the Fed's dovish pivot - but gold moved first.

The pattern:

Hard assets don't lead because they're "better." They lead because they respond to fear first.

Crypto has never front-run fear. It front-runs liquidity.

That's why this moment feels indistinguishable from being wrong.

But historically, this is what being early looks like.

Priced in Gold, Crypto Looks Like a Coiled Spring

Most people measure crypto in dollars. But if you measure it against the assets that are actually winning right now, the picture changes dramatically.

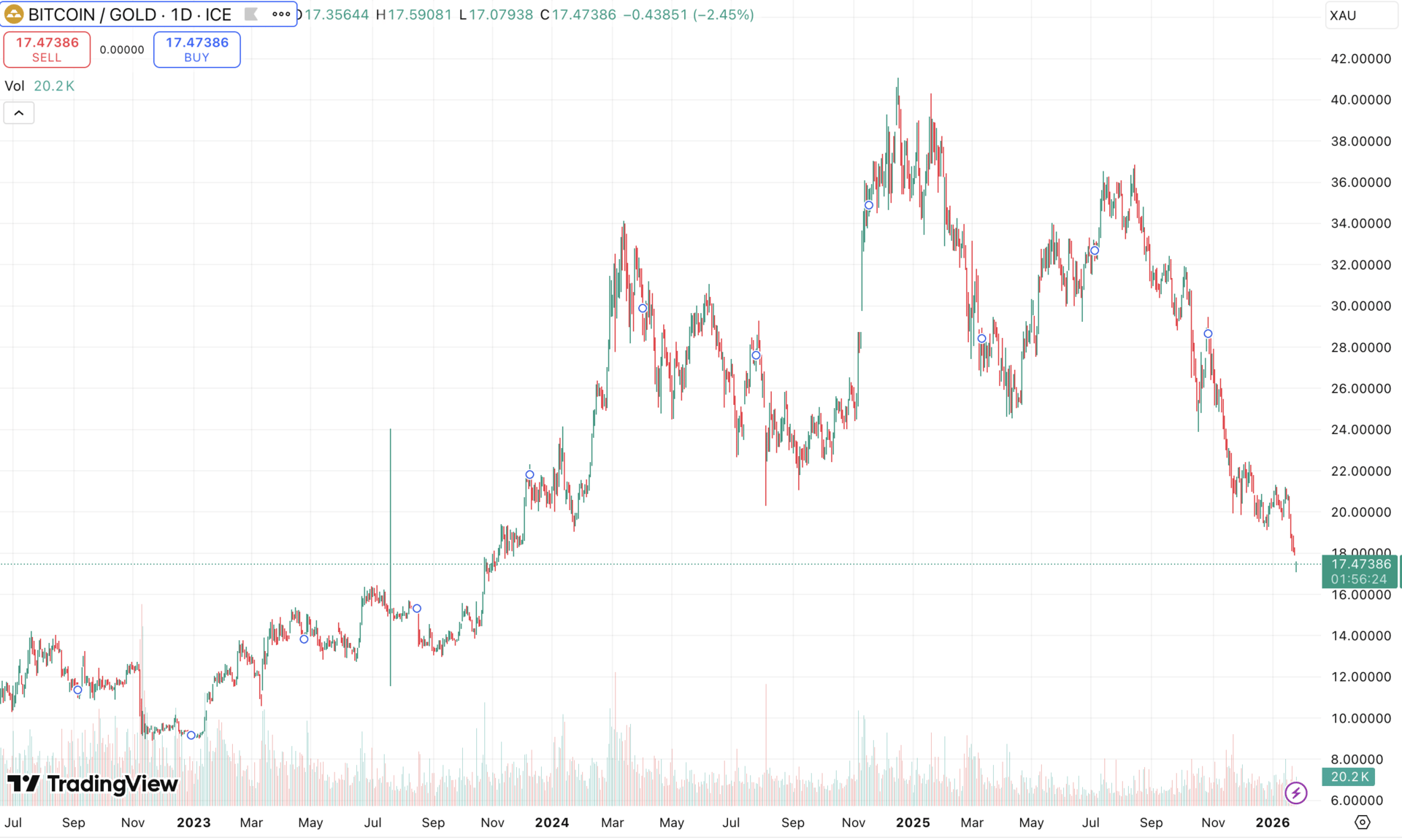

The BTC/Gold ratio - how many ounces of gold one Bitcoin buys - is currently around 18.

That's lower than it was in early 2024, before the halving rally. Before the ETF approvals. Before $36 billion in cumulative inflows.

At Bitcoin's October peak, the ratio was ~31. It's now compressed by over 40%.

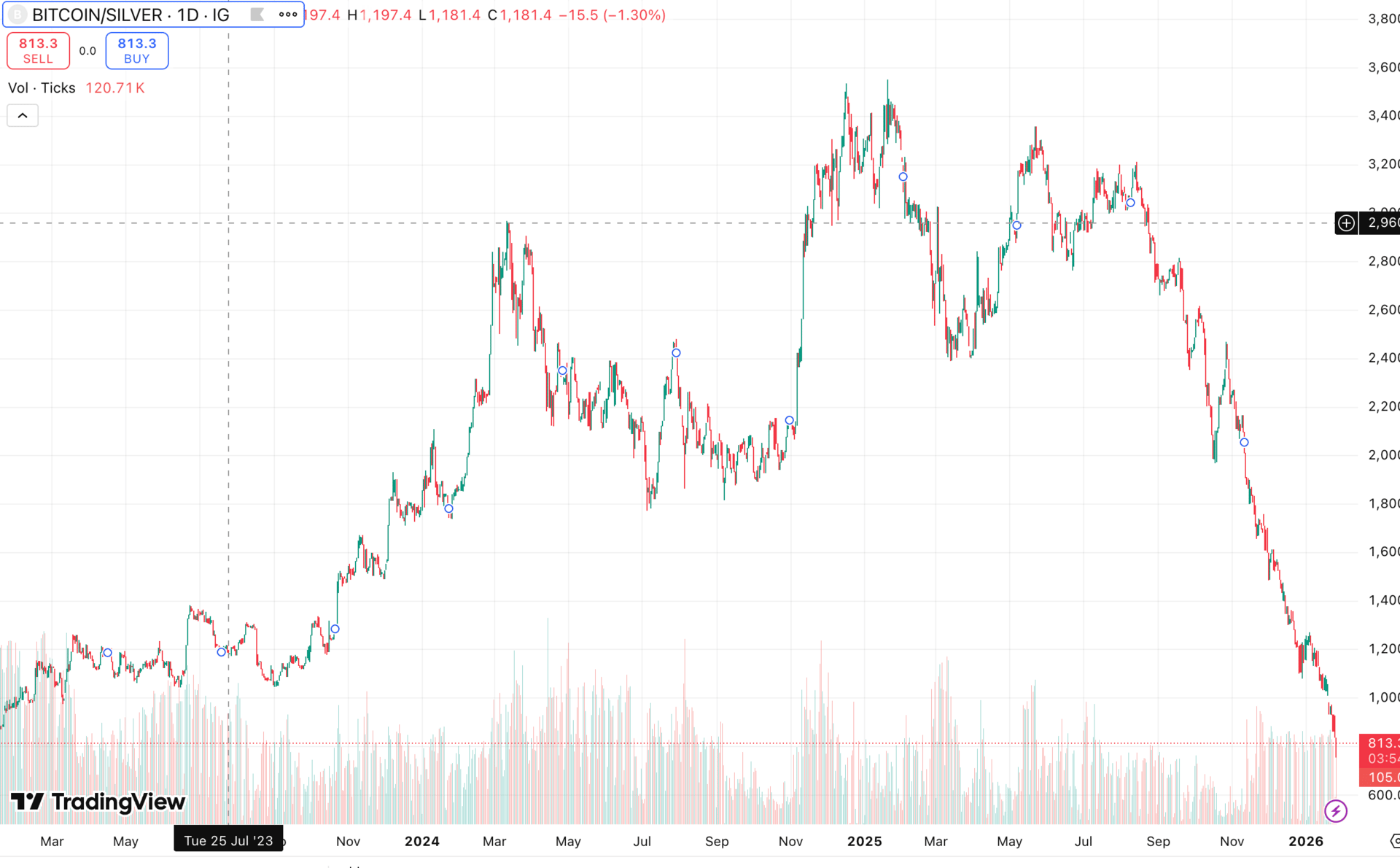

In silver terms, it's even more stark. Bitcoin has lost nearly half its purchasing power against silver since early 2024.

This isn't what "overvalued" looks like.

This is what "compressed against hard assets at historical extremes" looks like.

When the BTC/Gold ratio has been this depressed in the past, it's historically preceded significant crypto outperformance - because the ratio tends to mean-revert once liquidity conditions shift.

The hard asset rally didn't just leave crypto behind.

It created one of the most asymmetric setups in years.

What This Means for Altcoins

Bitcoin spent years trying to be "digital gold." That narrative is being stress-tested, and it's not holding the way gold is.

Altcoins never claimed to be gold.

Altcoins are protocols. Infrastructure. Rails. They're trying to be the next AWS, the next Visa, the next DTCC - not the next gold bar.

And if institutions eventually evaluate crypto as technology infrastructure rather than a commodity hedge, the framework changes completely.

Technology gets valued on fundamentals: revenue, usage, fees, developer activity, adoption curves.

The altcoins with real fundamentals - DeFi protocols generating fees, infrastructure layers with usage, RWA rails with institutional adoption - those are the ones positioned to catch flows as the regulatory picture clarifies.

Historically, altcoins have moved after Bitcoin in the sequencing. Bitcoin responds to liquidity. Then altcoins respond to Bitcoin - often with 2-5x the beta.

If you're positioned in quality protocols with real fundamentals, the setup is as good as it's been in years.

The Catalyst Is Forming

Let me be direct about the regulatory picture: it's moving, but unevenly.

The Digital Asset CLARITY Act had a markup scheduled for January 15. It was delayed. Politics are noisy. Markets are still pricing regulatory progress as uncertain - but the direction has clearly changed.

What's real:

The new administration is openly pro-crypto

The SEC has shifted from enforcement-by-ambiguity toward actual rulemaking

Spot Bitcoin ETFs normalized the asset class - over $36 billion in cumulative inflows since launch

Stablecoin legislation is taking shape

The structural blockers that kept institutions sidelined for years are starting to clear. Slowly. Messily. But directionally.

The Slate Is Clean

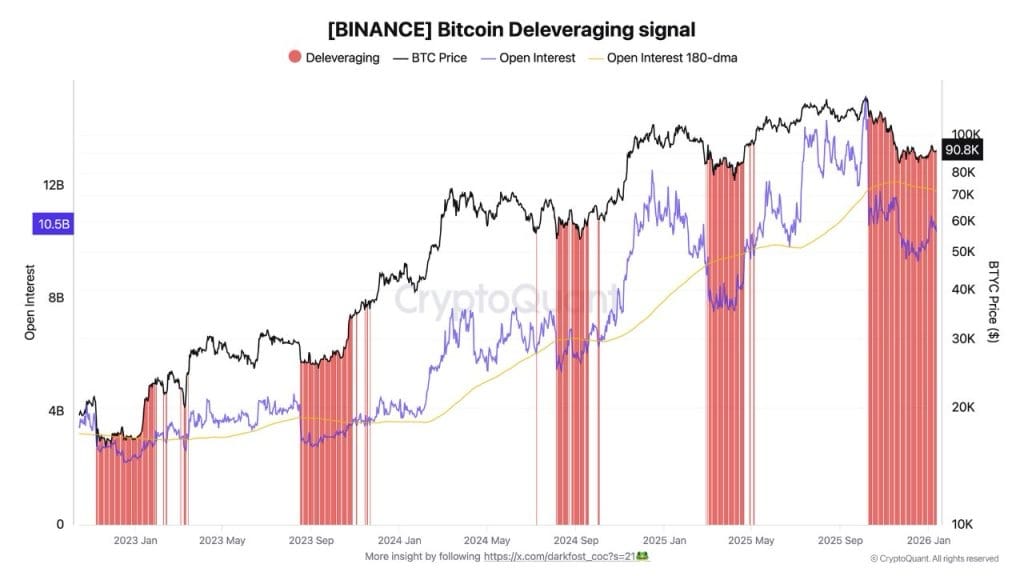

If you read the last newsletter, you know the leverage sitting on top of the market already broke. October and November flushed out the overcrowded positioning. Billions in liquidations. Open interest collapsed. The system reset.

That was painful. But it means:

Positioning is clean

Forced sellers are largely gone

The market is healthier

Now layer in the thesis clarification (crypto as policy-response asset), the historical sequencing (hard assets lead, crypto follows), and the regulatory catalyst forming.

The setup is building.

What Didn't Break

While prices ground sideways:

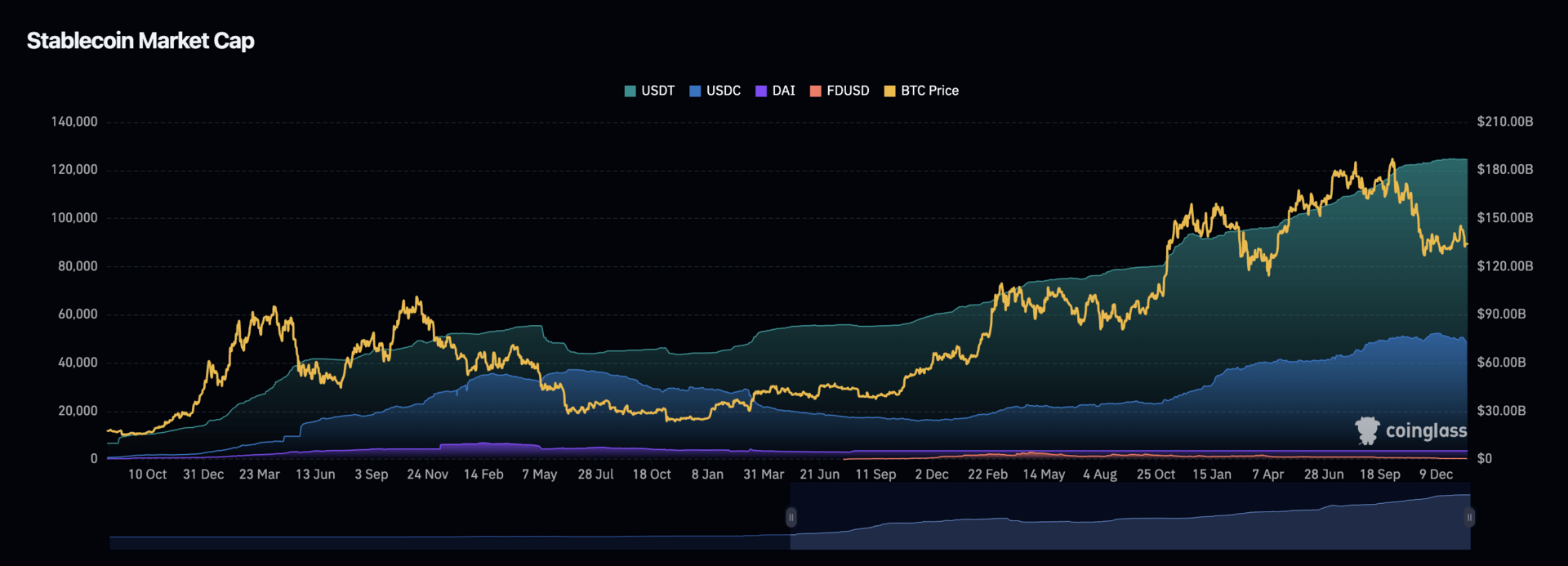

Stablecoin supply kept expanding. USDT and USDC market caps are at all-time highs. Capital didn't leave - it moved to the sidelines, waiting.

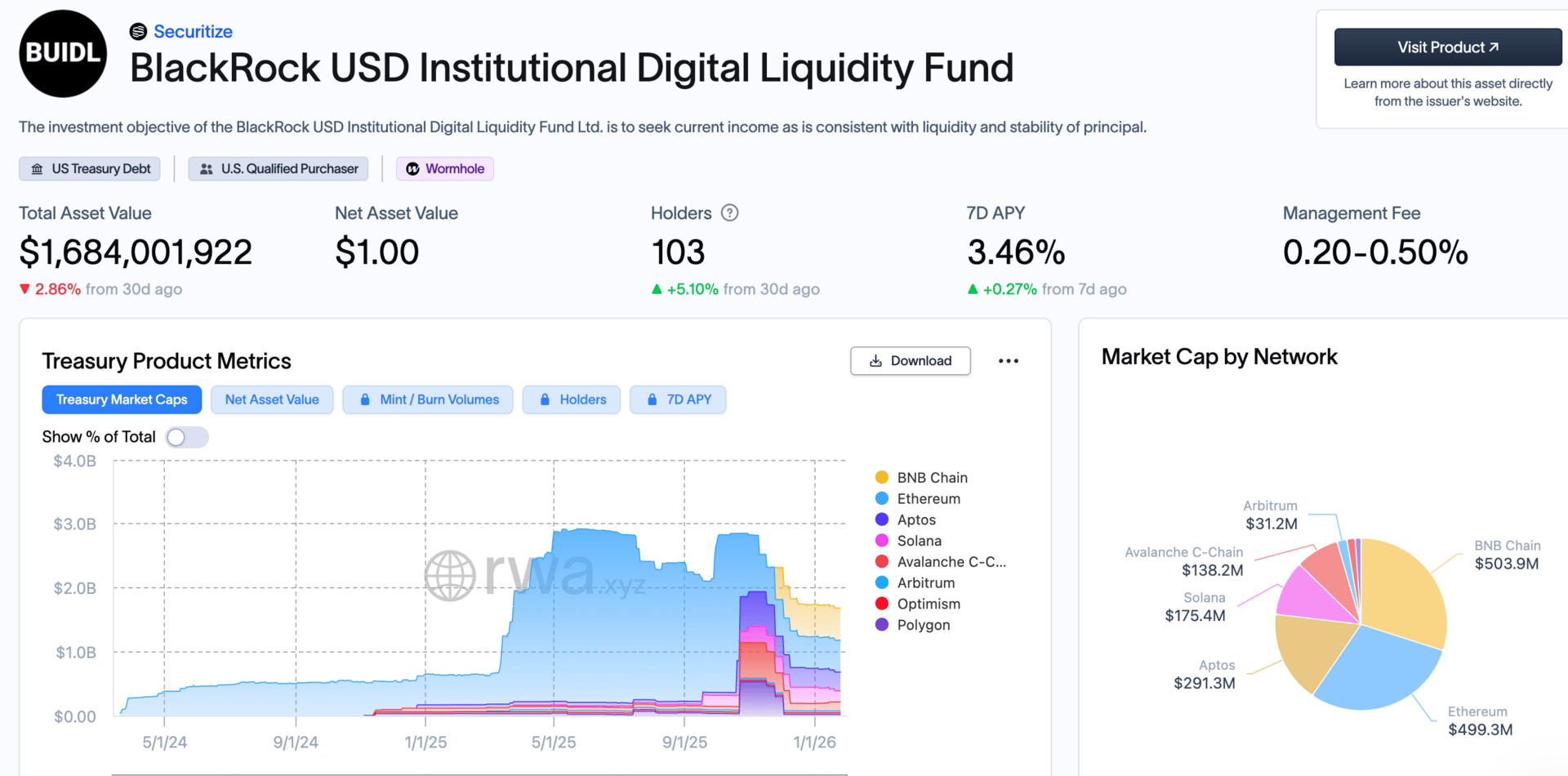

Tokenization accelerated. BlackRock's BUIDL fund crossed $1.6B. RWA rails are being built regardless of token prices.

Protocol revenue stayed meaningful. DeFi infrastructure kept generating fees. Usage didn't disappear.

This is not what a broken ecosystem looks like.

This is what a coiled spring looks like.

The Danger Right Now

The biggest risk isn't the drawdown you've already taken.

It's doing the classic behavioral mistake at the worst possible time:

Sell the thing that's down 30% (exhaustion)

Buy the thing that already 2x'd (relief)

Watch the regime flip

You'd be rotating from high convexity (crypto after compression) into lower convexity (metals after repricing) right as the historical window for crypto's move approaches.

If you sell BTC now to buy gold, you're selling at an 18:1 ratio that was 31:1 just months ago. You're locking in the worst exchange rate in years.

That's the trade that feels right and destroys returns.

Every prior cycle, the "I can't take it anymore" moment came right before the turn - not after.

What to Watch

We're in a transition. The signals that would confirm Phase 3 is arriving:

Fed language shifting dovish (watch the January FOMC)

Crypto ETF flows turning persistently positive (early signs in January)

Protocol revenue continuing to grow

Regulatory milestones landing (even partial wins)

Bitcoin responding to liquidity signals, not stress signals

Gold momentum slowing or consolidating (the handoff)

We're not calling a bottom. We're identifying where we are in a sequence that has repeated before.

So What Now

The market just told us something important.

Crypto isn't gold. It tried to be. The narrative didn't hold under stress. Gold did what gold does. Crypto didn't follow.

That's not a death sentence. It's a clarification.

Gold is the hedge in stress. Bitcoin is the hedge on the policy response to stress. Altcoins are the innovation exposure - selectively, for the ones with real fundamentals.

The hard asset rally isn't evidence that crypto failed. It's historically been the setup for crypto's move.

The leverage is flushed. The positioning is clean. The regulatory picture is forming. The BTC/Gold ratio is at multi-year lows.

The question isn't whether crypto failed to act like gold.

It's whether you want to own the asset before liquidity turns - or after.

More soon.

Mike

An ask

If this reframe was useful, feel free to pass along a subscription link to someone who might benefit: digitalwealthinsider.com

Disclaimer: This content is for informational and educational purposes only and should not be construed as investment, legal, or financial advice. Digital assets are highly volatile and carry risk. Always do your own research and consult with a licensed advisor before making financial decisions.