- Digital Wealth Insider Newsletter

- Posts

- From Crypto Allocation to Infrastructure Alpha

From Crypto Allocation to Infrastructure Alpha

Why Family Offices Are Asking the Wrong Question

Most family offices are still asking the wrong question about crypto allocation.

They want to know “how much Bitcoin should we hold?” when the real opportunity is understanding how institutional capital flows are reshaping the entire digital-asset landscape. Our flow tracker registered approximately US$2.4 billion of inflows into a major ETH spot ETF this month, while many allocators remain anchored in the 2017 “digital gold” story.

The market has fundamentally shifted. We’re no longer in the experimental phase; we’re in the institutional-adoption phase. BlackRock, Inc. is publicly signalling a major push into tokenisation: its BUIDL tokenised money-market fund already manages approximately US$2.8 billion AUM and the broader tokenised-RWA market has surpassed US$20 billion. That’s not speculation; that’s infrastructure being built in real-time.

Our fund positioning reflects this reality: heavy allocation to the intersection of AI and crypto, strategic exposure to real-world asset tokenization, and disciplined risk management that lets us capitalize on volatility rather than get destroyed by it.

The next 18 months will separate the investors who understood this transition from those still debating whether crypto belongs in a "serious" portfolio.

DWI Milestones

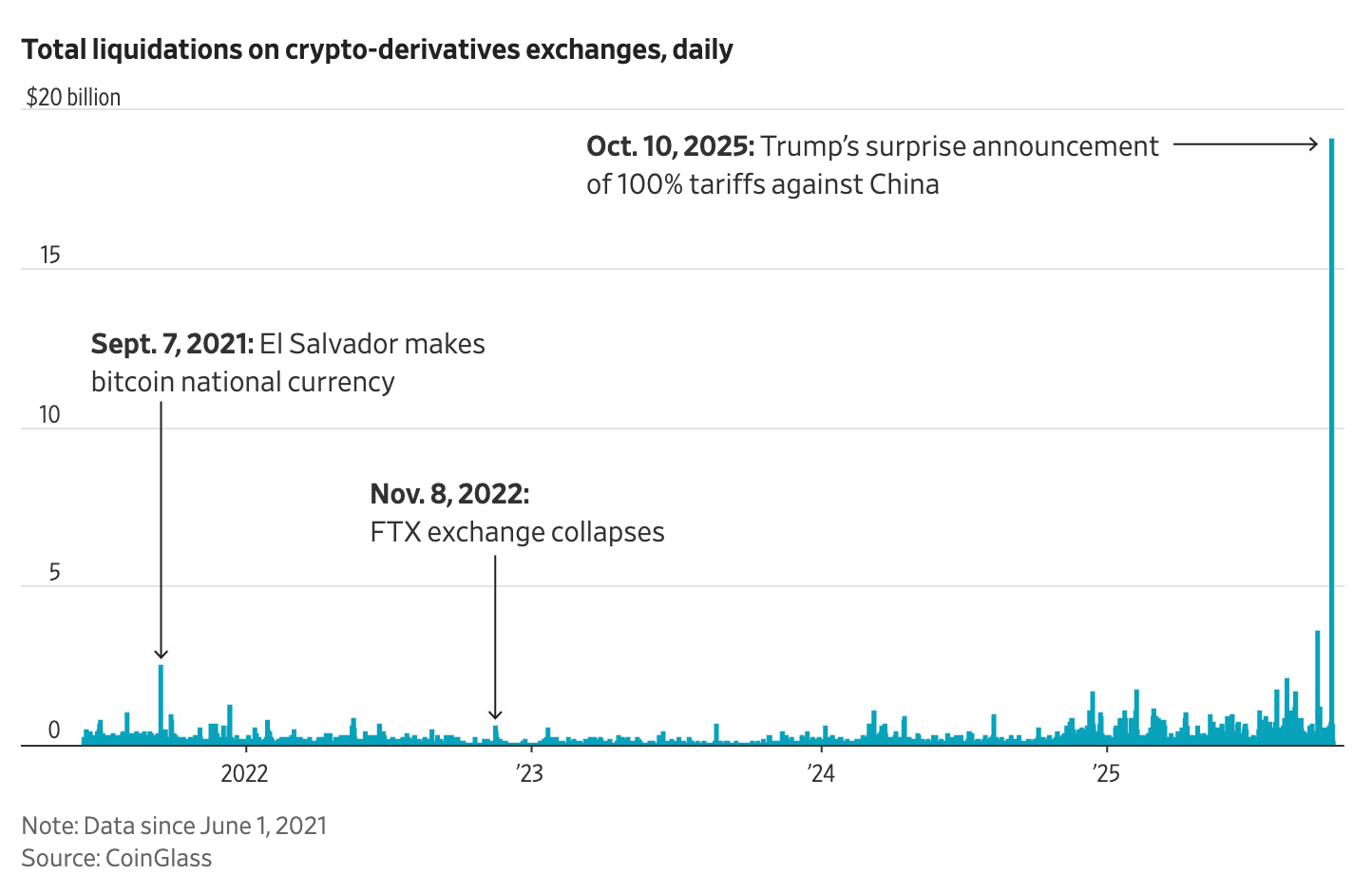

Crypto’s Major Drawdown Event: This past month saw about US$20 billion in liquidations, one of the largest on-chain events in crypto history. While many got caught, we avoided liquidations altogether: protecting investor capital while doubling down on quality assets under downward price pressure.

Token2049 Singapore: We attended the conference with a special focus on AI/agentic infrastructure protocols and decentralized-robotics solutions, gaining direct access to teams operating at the nexus of crypto × AI.

Digital Wealth Insider Founder Mike Klein

The Industry Topics You Can’t Miss

Ethereum Layer 2 Scaling Solutions Gain Institutional Traction Major enterprises are deploying on Ethereum L2s like Arbitrum and Polygon for lower costs and faster settlement. This validates our thesis on Ethereum's infrastructure dominance despite scaling challenges.

Privacy-Focused AI Infrastructure Tokens Surge Venice AI's recent token launch and similar privacy-preserving AI projects are gaining momentum as institutions recognize data sovereignty concerns. Early positioning in this intersection remains undervalued by traditional allocators.

Traditional Banks Accelerate Digital Asset Custody Services Following regulatory clarity, major custody banks are launching institutional-grade digital asset services. This infrastructure build-out signals the maturation phase of crypto adoption.

Stablecoins & RWAs — The Next Wave (and Scale) of Institutional Buy-in

The stablecoin market just crossed $300 billion in total supply, but the real story isn't just about size, it's also about the sophistication.

Traditional finance is quietly building the infrastructure that makes digital assets inevitable. When PayPal launches PYUSD for enterprise payments, we're not talking about crypto adoption anymore. We're talking about the modernization of money movement.

The Infrastructure Play Most Investors Miss

What family offices don't realize is that stablecoins solve the settlement problem that has plagued institutional trading for decades. Instead of T+2 settlement cycles, we're seeing T+0 finality. Instead of correspondent banking relationships and SWIFT transfers, we have programmable money that moves 24/7.

USD Coin (USDC)’s 30-day average on-chain transfer volume routinely exceeds US$40 billion. Tether handles more daily volume than most traditional payment networks. These aren't speculative assets, they're becoming critical financial infrastructure.

The investment thesis isn’t simply ‘buy stablecoins.’ It’s about identifying the protocols and infrastructure providers that will capture the value as this transition accelerates. We believe the next generation of winners: the ‘next Circle, Fireblocks or Chainlink Labs-type platform-builders, haven’t even hit their stride yet.

Real-World Assets: Beyond Treasury Bills

Tokenisation of real-world assets (RWAs) is following the same pattern of infrastructure discovery, but most allocators are thinking too small. The on-chain RWA tokenisation market has crossed ~US$23 billion in mid-2025, marking a 260%+ surge. From institutional credit funds tokenising loan portfolios, real-estate funds issuing fractional property equity, to insurance policies, carbon credits and IP rights being digitised and traded 24/7, this is asset-management’s transformation.

From a VC perspective, this creates multiple layers of opportunity:

Layer 1: Infrastructure - The protocols that enable tokenization, custody, and trading of real-world assets. Think of this as the "Stripe for tokenization" opportunity.

Layer 2: Asset Originators - Traditional financial institutions and asset managers who are tokenizing their products for broader distribution and enhanced liquidity.

Layer 3: Ecosystem Services - KYC/AML providers, oracle networks, insurance protocols, and yield optimization strategies that make institutional participation possible.

The Asymmetric Opportunity

Alpha in this transition doesn’t come from merely purchasing tokenised assets; it comes from understanding the value chain that enables them. Our fund holds strategic positions across all three layers, and we emphasize Ethereum-based and Solana-based infrastructure given institutional preferences for those ecosystems. We’re not just buying tokenised Treasury bills; we are owning the companies and protocols that scale Treasury-bill tokenisation.

More importantly, we’re positioned for the second-order effects: when a family office can instantly access fractional ownership in a US$100 million commercial real-estate transaction via their existing brokerage account, the distinction between “traditional” and “digital” assets collapses. That transition accelerates wealth-inequality for those unprepared, but creates generational opportunities for early movers.

Practical Implementation

For family offices considering exposure, we might recommend a barbell approach: a conservative allocation to established infrastructure (e.g., BlackRock’s tokenised funds) paired with selective positions in next-generation protocols that haven’t yet seen institutional scale.

The key is understanding: this isn’t a “crypto play”: it’s a financial-infrastructure upgrade. The institutions that position early will capture the liquidity premium as traditional assets migrate on-chain over the next 24 months. Treating this as a standalone “crypto allocation” means missing the forest for the trees. This is portfolio construction being rebuilt from the ground up for better settlement, instant liquidity, programmable features that make traditional asset management look antiquated.

By 2026, the question won't be whether to allocate to digital assets. It will be, which managers understood the transition early enough to capture the best opportunities.

For more insights on institutional crypto allocation strategies, visit [digitalwealthinsider.beehiiv.com] or reach out directly for portfolio consultation.

Mike Klein

Founding Partner, Digital Wealth Insider

Disclaimer:

This content is for informational and educational purposes only and should not be construed as investment, legal, or financial advice. Nothing in this newsletter constitutes a solicitation, recommendation, or endorsement of any investment strategy or protocol. Digital assets are highly volatile and carry risk. Always do your own research and consult with a licensed advisor before making financial decisions.